2016年08月21日

なぜ遺伝子治療薬はあんなに高いのか。(2) 英国銀行 後遺症の扱い 7年間での初めての金利の動きはBrexitによって引き起こされた金利低減である。

Pharma supporters will also point out that the price of Strimvelis is significantly lower than that of another therapy, Glybera, which was the first to be sold in Europe (for a genetic condition that causes a dangerously high amount of fat to build up in the blood system). At $1m, it was bought only once since it was introduced in 2012 and has been a commercial failure. The lesson from this, and one that loomed large in the pricing of Strimvelis, was that it is possible to charge too much—even for a cure. Drug companies are also trying to argue that the cost of cures for diseases need to be set against the overall benefit to the health-care system. The cost of treating ADA-SCID with an enzyme-replacement therapy can run into many hundreds of thousands of dollars a year. Nonetheless, with growing numbers of costly therapies of different kinds expected to arrive in the near future, there are worries about how health-care systems will afford them all. It isn’t all doom and gloom, however. Over time the cost of making these therapies will decline: patents will run out and labour-intensive parts of the process will be automated. It may also become possible to develop off-the shelf treatments one day. The process of industrialising gene therapies is only just beginning.

loom large: 〔危険・心配などが〕大きく迫る[立ちはだかる]

enzyme:酵素

doom and gloom:散々な目・将来に希望が持てない

run out:我慢が限界を超える

もっと高い治療方法を必要とする別の病気の治療方法もあったが、高すぎてうまくいかなかった。今後こうした高額な治療はだんだん改善されていくだろうという記事だ。もっともな話だ。この記事を読んで、こうした医療は政府とか公的な機関が支援するべきだろう。そう思った。

The Bank of England

Treating the hangover

The first interest-rate move in seven years is a Brexit-induced cut

Aug 6th 2016 | From the print edition

英国銀行

後遺症の扱い

7年間での初めての金利の動きはBrexitによって引き起こされた金利低減である。

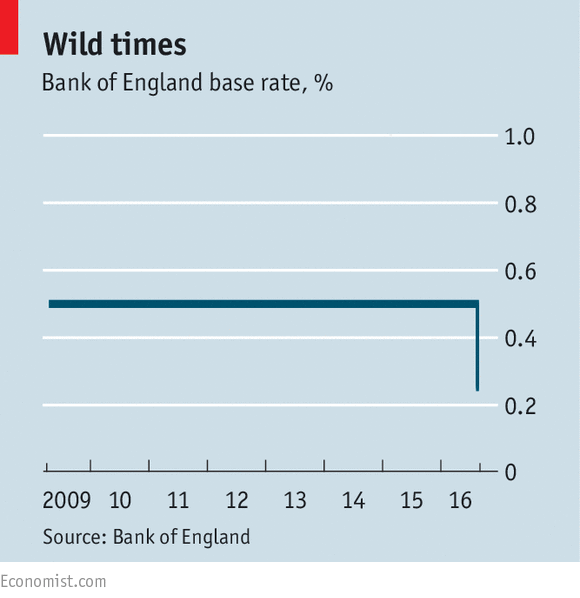

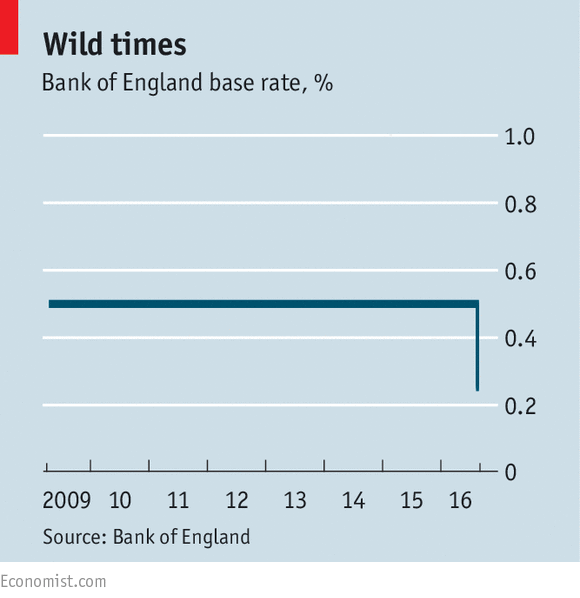

THE Bank of England had not changed base rates in seven years, but when it finally moved, it did so. In response to the low growth it expects in the wake of Brexit, it cut rates by a quarter point, to 0.25%, expanded its quantitative easing scheme and introduced a new funding scheme for banks. The move came on August 4th—three prime ministers, two disappointing European football championships and one referendum since the last wiggle in the rate.

with a bang:華々しく・大きな音を立てて

wiggle:、小刻みな動き

The cut, when it finally came, was fully expected by markets and indeed looked overdue. In the days immediately after the Brexit vote, Mark Carney, the governor of the bank, hinted that the MPC would be ready to respond aggressively to the presumed economic blowback. Yet at its July meeting the MPC held fast while awaiting more data. The news since has been almost uniformly bad. Manufacturing, service-sector and construction activity all shrank sharply in July, the latter two at the fastest pace since 2009. Measures of economic confidence have also taken a tumble, and surveys of business reveal a broad pessimism across firms as orders from abroad dry up. The British economy seems destined to suffer through at least a mild recession.

overdue:もっと早くするべきで

hinted:ほのめかす

blowback:〔否定的な〕反応 〔外交の〕ブローバック◆アメリカのCIAの用語で、外交政策が原因となって自国にもたらされる予期できない負の結末。支持していた政権が自国に敵対的になってテロを仕掛けることなどを指す。

MPC:Monetary Policy Committee 金融政策委員会◆国営銀行であるイングランド銀行に属する。

held fast :固執する

uniformly:一様に

confidence:信頼

taken a tumble:下降線をたどる・転倒

In responding to the danger, the bank opted to do more than cut rates. It will also restart quantitative easing (printing money to buy bonds). The MPC pledged to buy £60 billion ($80 billion) in government bonds and up to £10 billion in corporate bonds over the next 18 months. That is on top of the £375 billion of assets already purchased. Both measures are meant to keep credit taps open and provide a lifeline to firms; analysts expect bank lending to companies to contract in coming months. The new funding scheme is designed to help banks and building societies which might otherwise struggle to cut their lending rates in line with base rates.

credit taps:与信枠の蛇口

Yet having warned before the referendum that monetary policy could only do so much to limit the damage from Brexit, Mr Carney will be hoping for co-operation from the government. Interest rates are already very low: a small business can borrow for 3.5% a year, for instance, down from 7% when the financial crisis hit. A bold new programme of public investment spending might do more to shore up both business confidence and demand than central-bank bond-buying. Unfortunately, Philip Hammond, the chancellor, seems to be in no rush: the government’s spending plans are not expected to change until October. A recession might be under way before fiscal stimulus begins working its way through the economy.

shore up:補強する

Were this a typical recession, Britain’s best hope might be a rise in exports to the continent. The interest-rate cut should keep the downward pressure on sterling, and the European recovery continues to plod along. Yet European firms will be reluctant to spend more money in Britain until the future of its relationship with the EU is clearer. For now, Britons must sleep in the bed Leave voters have made—and hope the Remain campaign’s economic warnings prove excessively pessimistic.

plod :ゆっくり進む

日曜日。今日はこれまで。Brexitの影響で英国銀行は金利を下げ、量的緩和政策をとることにした。景気が悪くなってきていて、さらに企業への貸し出し支援政策も検討しているが、景気悪化の状況は芳しくない。ヨーロッパも英国への投資を控えている。今後このBrexitによるどうなっていくのだろうか。

昨日は海野塾があった。懇親会もあった。今日は朝から城南島のスケーターのBBQ大会に行く。Hypnoのウィールがもらえるので、その準備をしなければならない。2時からは英語の研修資料作成がある。5時半からは池袋で新しい事務所の契約がある。忙しい1日になりそうだ。ではまた明日。

loom large: 〔危険・心配などが〕大きく迫る[立ちはだかる]

enzyme:酵素

doom and gloom:散々な目・将来に希望が持てない

run out:我慢が限界を超える

もっと高い治療方法を必要とする別の病気の治療方法もあったが、高すぎてうまくいかなかった。今後こうした高額な治療はだんだん改善されていくだろうという記事だ。もっともな話だ。この記事を読んで、こうした医療は政府とか公的な機関が支援するべきだろう。そう思った。

The Bank of England

Treating the hangover

The first interest-rate move in seven years is a Brexit-induced cut

Aug 6th 2016 | From the print edition

英国銀行

後遺症の扱い

7年間での初めての金利の動きはBrexitによって引き起こされた金利低減である。

THE Bank of England had not changed base rates in seven years, but when it finally moved, it did so. In response to the low growth it expects in the wake of Brexit, it cut rates by a quarter point, to 0.25%, expanded its quantitative easing scheme and introduced a new funding scheme for banks. The move came on August 4th—three prime ministers, two disappointing European football championships and one referendum since the last wiggle in the rate.

with a bang:華々しく・大きな音を立てて

wiggle:、小刻みな動き

The cut, when it finally came, was fully expected by markets and indeed looked overdue. In the days immediately after the Brexit vote, Mark Carney, the governor of the bank, hinted that the MPC would be ready to respond aggressively to the presumed economic blowback. Yet at its July meeting the MPC held fast while awaiting more data. The news since has been almost uniformly bad. Manufacturing, service-sector and construction activity all shrank sharply in July, the latter two at the fastest pace since 2009. Measures of economic confidence have also taken a tumble, and surveys of business reveal a broad pessimism across firms as orders from abroad dry up. The British economy seems destined to suffer through at least a mild recession.

overdue:もっと早くするべきで

hinted:ほのめかす

blowback:〔否定的な〕反応 〔外交の〕ブローバック◆アメリカのCIAの用語で、外交政策が原因となって自国にもたらされる予期できない負の結末。支持していた政権が自国に敵対的になってテロを仕掛けることなどを指す。

MPC:Monetary Policy Committee 金融政策委員会◆国営銀行であるイングランド銀行に属する。

held fast :固執する

uniformly:一様に

confidence:信頼

taken a tumble:下降線をたどる・転倒

In responding to the danger, the bank opted to do more than cut rates. It will also restart quantitative easing (printing money to buy bonds). The MPC pledged to buy £60 billion ($80 billion) in government bonds and up to £10 billion in corporate bonds over the next 18 months. That is on top of the £375 billion of assets already purchased. Both measures are meant to keep credit taps open and provide a lifeline to firms; analysts expect bank lending to companies to contract in coming months. The new funding scheme is designed to help banks and building societies which might otherwise struggle to cut their lending rates in line with base rates.

credit taps:与信枠の蛇口

Yet having warned before the referendum that monetary policy could only do so much to limit the damage from Brexit, Mr Carney will be hoping for co-operation from the government. Interest rates are already very low: a small business can borrow for 3.5% a year, for instance, down from 7% when the financial crisis hit. A bold new programme of public investment spending might do more to shore up both business confidence and demand than central-bank bond-buying. Unfortunately, Philip Hammond, the chancellor, seems to be in no rush: the government’s spending plans are not expected to change until October. A recession might be under way before fiscal stimulus begins working its way through the economy.

shore up:補強する

Were this a typical recession, Britain’s best hope might be a rise in exports to the continent. The interest-rate cut should keep the downward pressure on sterling, and the European recovery continues to plod along. Yet European firms will be reluctant to spend more money in Britain until the future of its relationship with the EU is clearer. For now, Britons must sleep in the bed Leave voters have made—and hope the Remain campaign’s economic warnings prove excessively pessimistic.

plod :ゆっくり進む

日曜日。今日はこれまで。Brexitの影響で英国銀行は金利を下げ、量的緩和政策をとることにした。景気が悪くなってきていて、さらに企業への貸し出し支援政策も検討しているが、景気悪化の状況は芳しくない。ヨーロッパも英国への投資を控えている。今後このBrexitによるどうなっていくのだろうか。

昨日は海野塾があった。懇親会もあった。今日は朝から城南島のスケーターのBBQ大会に行く。Hypnoのウィールがもらえるので、その準備をしなければならない。2時からは英語の研修資料作成がある。5時半からは池袋で新しい事務所の契約がある。忙しい1日になりそうだ。ではまた明日。

RSS

RSS グローバル人材育成の道|海野惠一(元アクセンチュア代表)

グローバル人材育成の道|海野惠一(元アクセンチュア代表)